Connecting Trust in Traditional & Decentralized Finance

TAX-TCT (Tax Trading Commercial Transfer) delivers expert compliance, decentralized investment, and blockchain solutions to bridge traditional and digital finance.

Why Choose TAX-TCT?

Ensure Regulatory Compliance

Stay compliant with AML, KYC, and tax regulations through expert coordination with regulatory bodies and comprehensive audits.

Maximize DeFi Opportunities

Unlock the potential of decentralized finance with secure digital asset evaluation and risk management tailored for DeFi platforms.

Leverage Advanced Technology

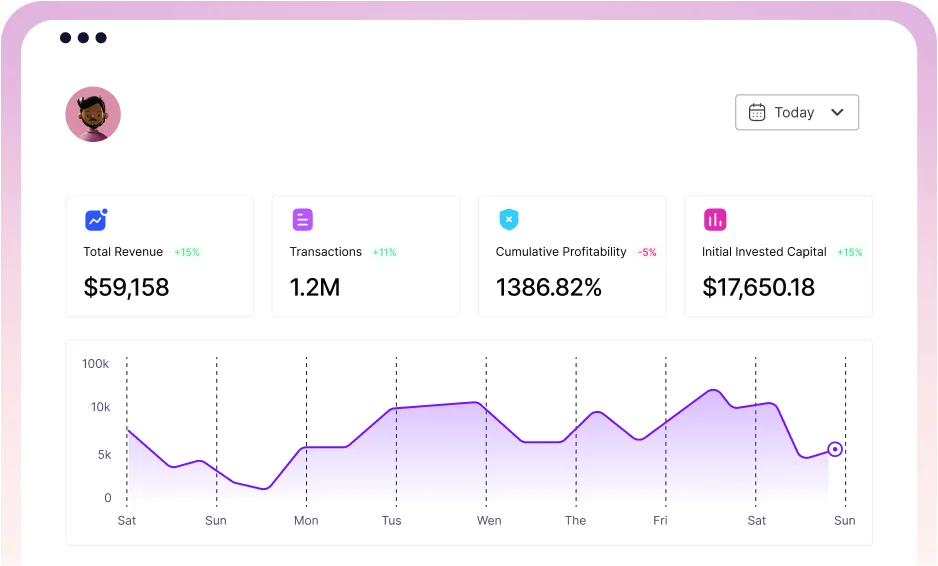

Transform your operations with cutting-edge blockchain solutions, custom software, and specialized IT services for financial innovation.

Our Specialized Services for Your Success

Regulatory and Tax Certification Management

Ensure adherence to AML, KYC, and tax regulations with expert management.

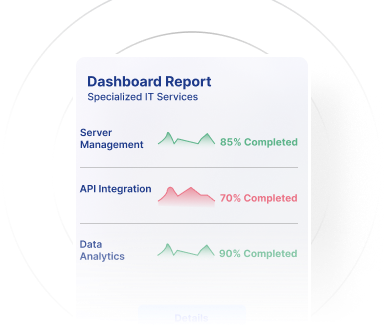

Specialized IT Services

Deliver specialized IT services with cutting-edge technology solutions.

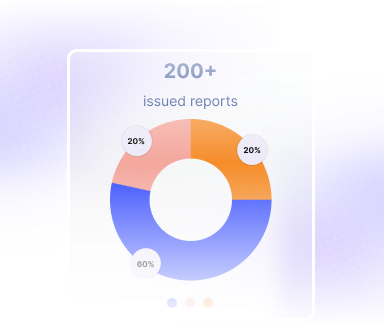

Issuance of Technical Inquiry Reports

Provide detailed, accurate technical reports for regulatory compliance.

Why TAX-TCT Is Your Ideal Partner

Stay compliant with AML, KYC, and tax regulations through expert coordination with regulatory bodies and comprehensive audits.

- Regulatory Compliance

- Digital Asset Tracking

- Blockchain Forensics

- Financial Auditing

- Tax Certifications

- Web Portal Management

- Blockchain Forensics

- Trust & Transparency

- Secure Solutions

- Global Standards

- Expert Insights

- Innovative Technology

- Client Success

- Secure Solutions

Overcome Compliance & Financial Hurdles

Address regulatory complexities and fund flow risks with our automated audits and blockchain-powered tracking solutions.

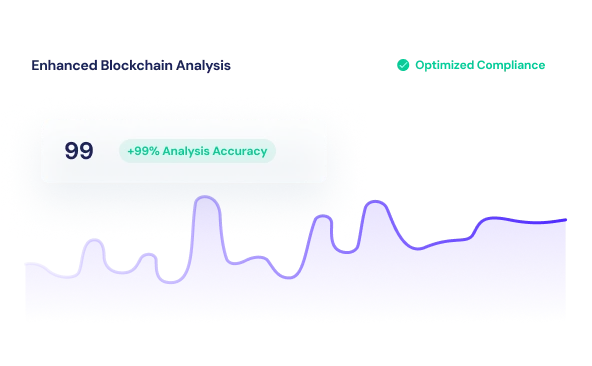

ARAF: Leading Research for Smarter Compliance

Our ARAF division delivers cutting-edge research to enhance blockchain analysis and regulatory compliance strategies.

Insights for the Future of Finance

Tailor Your TAX-TCT Solution in Seconds

Select your needs and get a personalized consultation or report to boost your compliance and DeFi strategies.

Trustpilot

Email: Info@taxtct.com , info@taxuk.online | Phone: +44 7480 219471

please see our FAQs.

Services

Services

Quick Links

© 2026 All Rights Reserved.